From Pipelines to Platforms: Why Financial Services Must Rethink How They Create Value

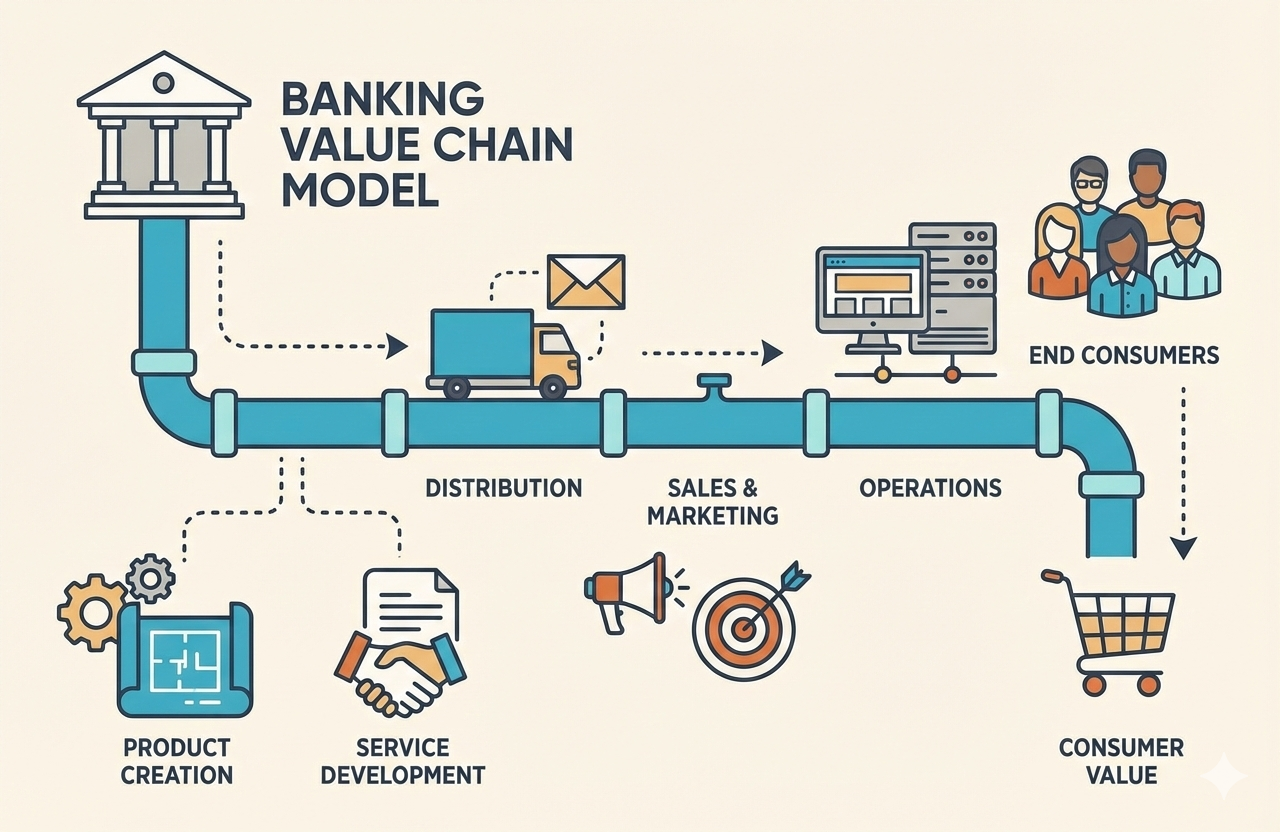

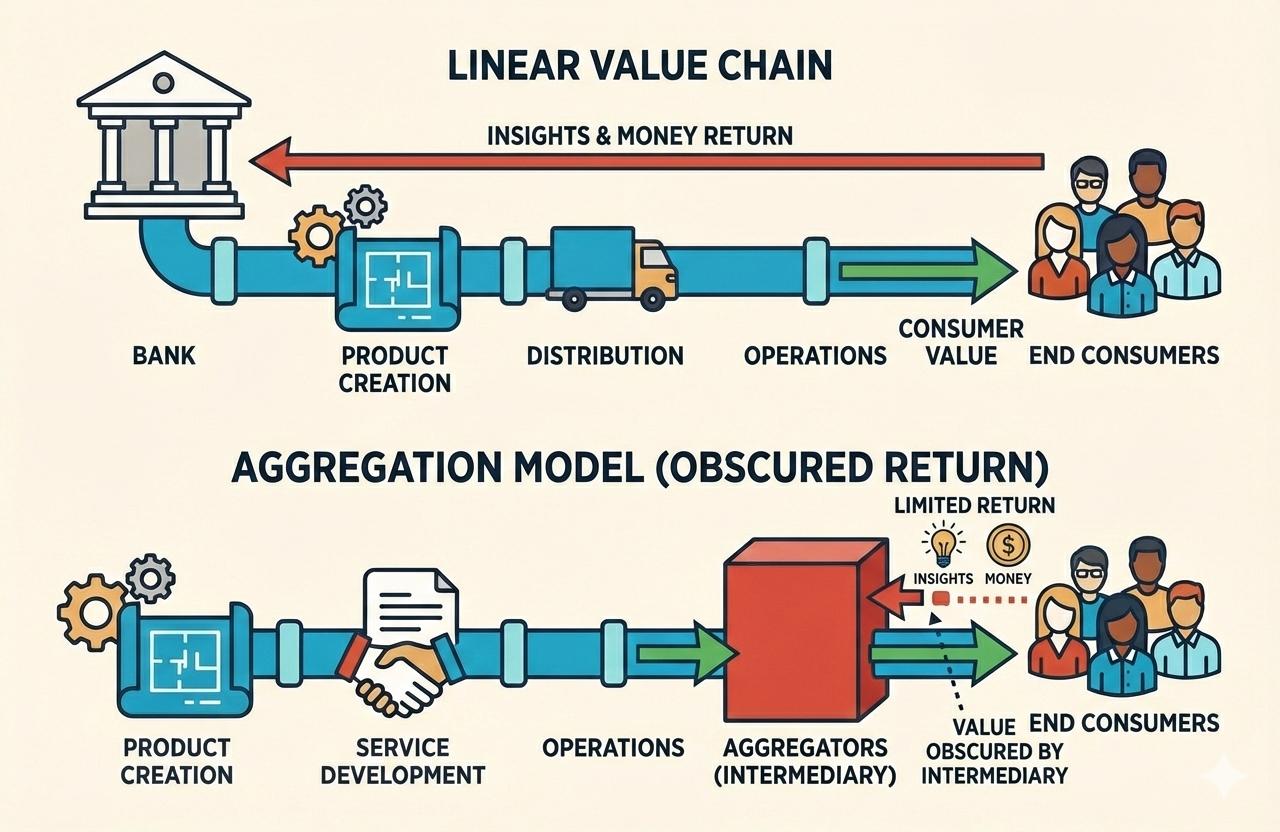

Like most traditional industries, banks and credit unions are built on linear value chains. Products are created internally, delivered through owned channels, and growth is driven by pushing greater volume outward as money and insight return to the system.

This model served the industry well for a long time.

Even as digital innovation accelerated, FinTech introduced innovative financial experiences, prompting banks and credit unions to adopt similar features such as mobile-first design and faster onboarding; the underlying structure remained largely unchanged. New channels were added, processes became faster, and interfaces improved, but the fundamental mechanics of value creation stayed the same.

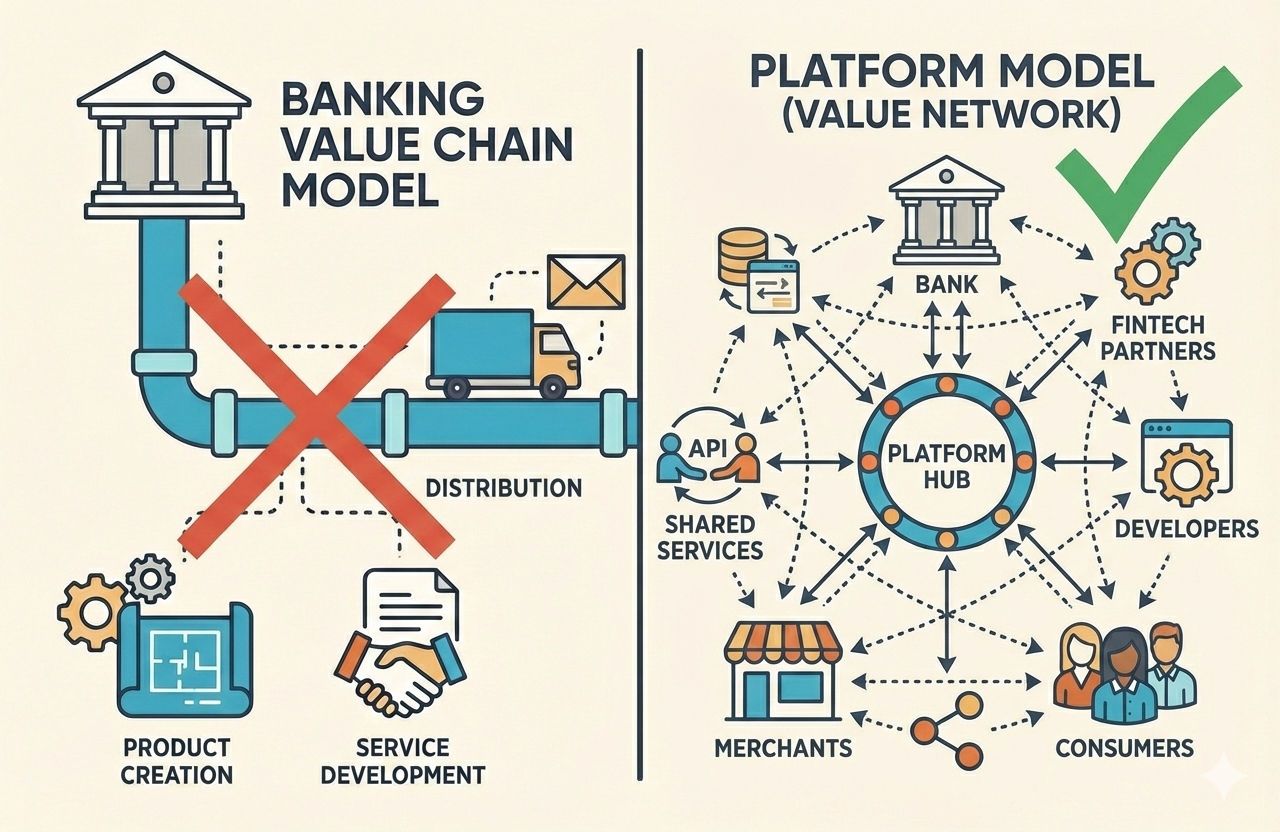

Beneath the surface, a profound shift has taken place over the past twenty years: value creation is moving from linear pipelines to platform-based models.

The platform shift finance can no longer avoid

In 2016 Harvard Business Review’s (HBR) seminal piece Pipelines, Platforms, and the New Rules of Strategy highlighted a fundamental shift in the digital economy: value creation is moving from linear chains to platform-based models, a change already underway rather than a future prediction.

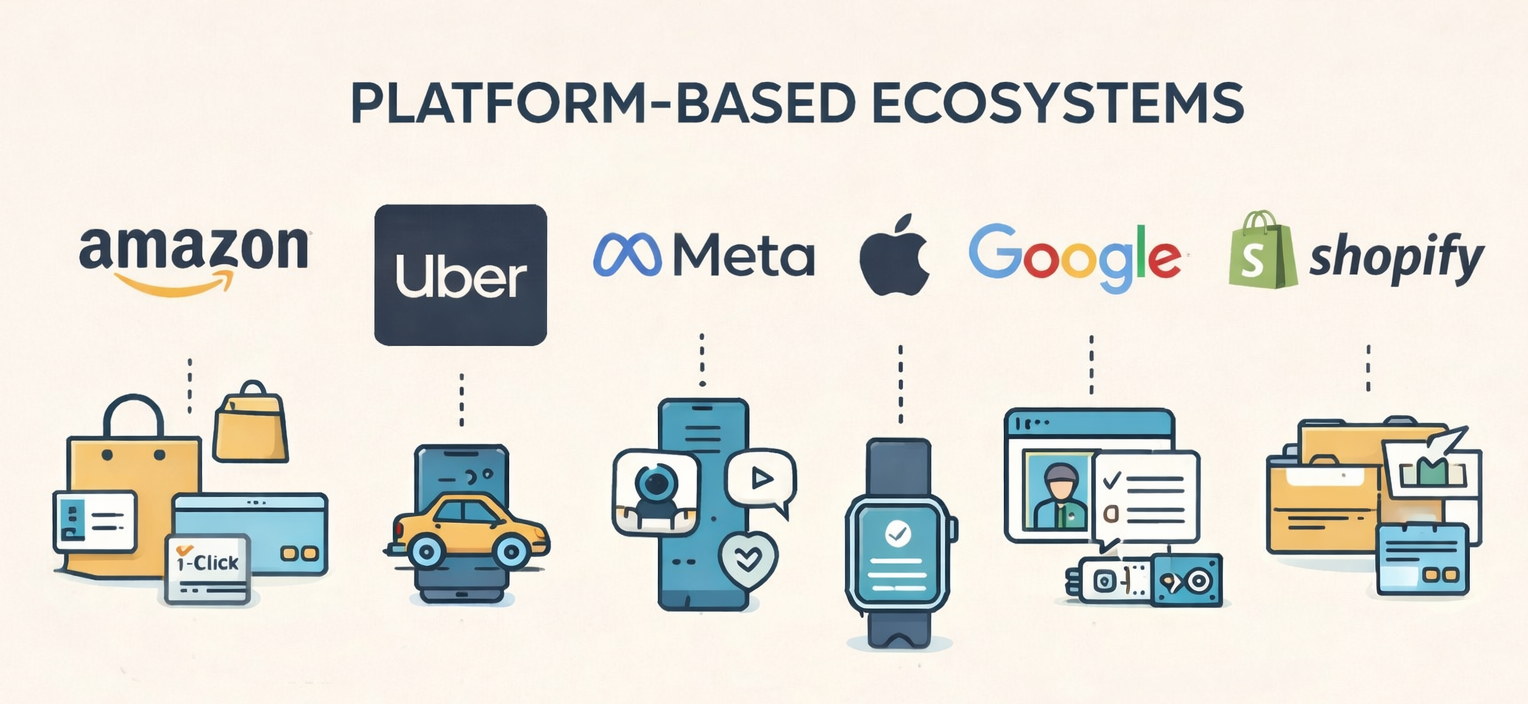

This shift truly took hold with the advent of the iPhone in 2007, marking the moment when products stopped serving merely as final destinations or discrete tools. Instead, they became launchpads for ongoing value creation, acting as gateways to interconnected platforms and rich ecosystems where a multitude of services and interactions could thrive.

Across industries, value emerges from platforms facilitating exchange and collaboration, shifting control from chain ownership to system participation.

The question facing financial institutions today is not just how many new innovative use cases can be delivered through existing pipelines, but whether those pipelines are the right foundation for the next era of competition.

Because the shift that now matters more than features or volume is about the structural platform that will enable everything that comes next.

Behaviour has already moved. Finance is catching up.

For almost 20 years, platform-based delivery has driven a behavioral shift that is now normalized and widely expected, fundamentally now shaping how people engage with financial services.

As more of daily life increasingly happens within platform ecosystems, people are no longer “visiting” services but completing tasks in context.

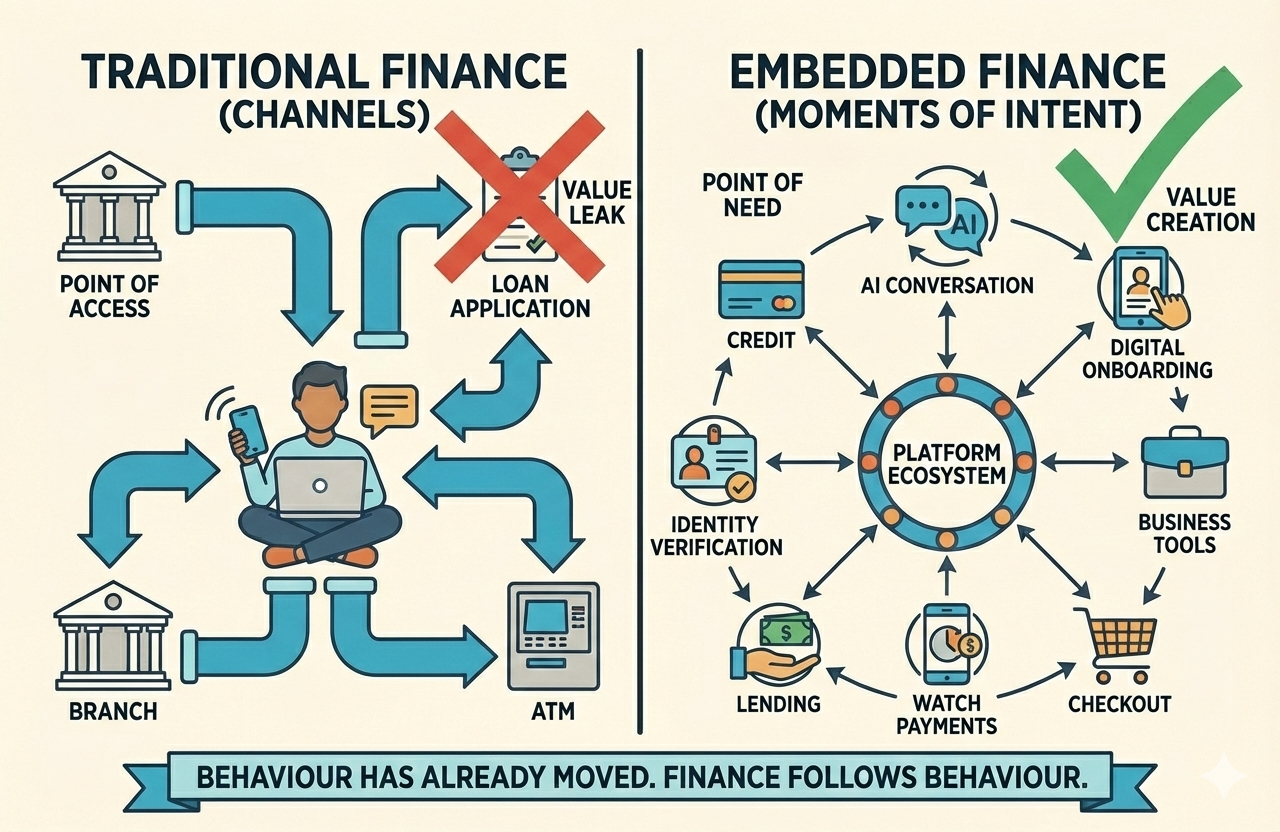

Consumers expect financial services to meet them at their point of need, not at the point of access. Credit at checkout. Payments inside AI conversations. Identity verification inside digital onboarding journeys. Lending inside business tools. Payments on a tap of their watch. Money no longer feels like a destination, or even a tangible product, it is an embedded function.

This is why large platforms and Big Tech have moved so naturally into financial services. Not because they aspire to become banks, but because platforms naturally absorb the transactions already occurring within their ecosystems. Finance follows behaviour. This is not a new phenomenon. Money has always followed people. We explored this in more detail in our recent post, From Cash to Card to Code: Money Follows People. What has changed is the environment in which that behaviour now occurs. When behaviour shifts but delivery models do not, value leaks.

Traditional financial institutions still optimize around channels.

Platforms optimize around moments of intent.

Aggregators: New Pipes, Same Old Extraction

Many financial institutions turn to aggregators to meet open banking and data needs because they offer broad connections and rapid compliance.

Aggregators have also cemented their market dominance thanks to their longstanding use of screen-scraping techniques, which, despite being a workaround, allowed them to quickly establish broad connectivity ahead of the development of reliable APIs (Application Programming Interfaces). This legacy has enabled them to become the default intermediaries for data access, even as the underlying technology has evolved, reinforcing their central position within the financial data ecosystem.

Even with upgraded access, where available via APIs, the business model remains outdated. In essence, aggregators act as black box intermediaries, obscuring the flow of data and insights within pipelines that ultimately becomes extractive. In reality, it’s still the same old business model built around screen-scraping, just a black box intermediary sitting between parties, modernised in appearance but unchanged at its core.

Aggregators are simply extractive pipelines, they optimize throughput, not interaction.

The Bank pays for the infrastructure.

The Aggregator sits in the middle.

The Third Party extracts the value.

Financial institutions don't just need broader connectivity; they need to stop leaking value and paying for that privilege! It is time to move away from extractive intermediaries and toward a true platform model where banks and credit unions participate in the value they create.

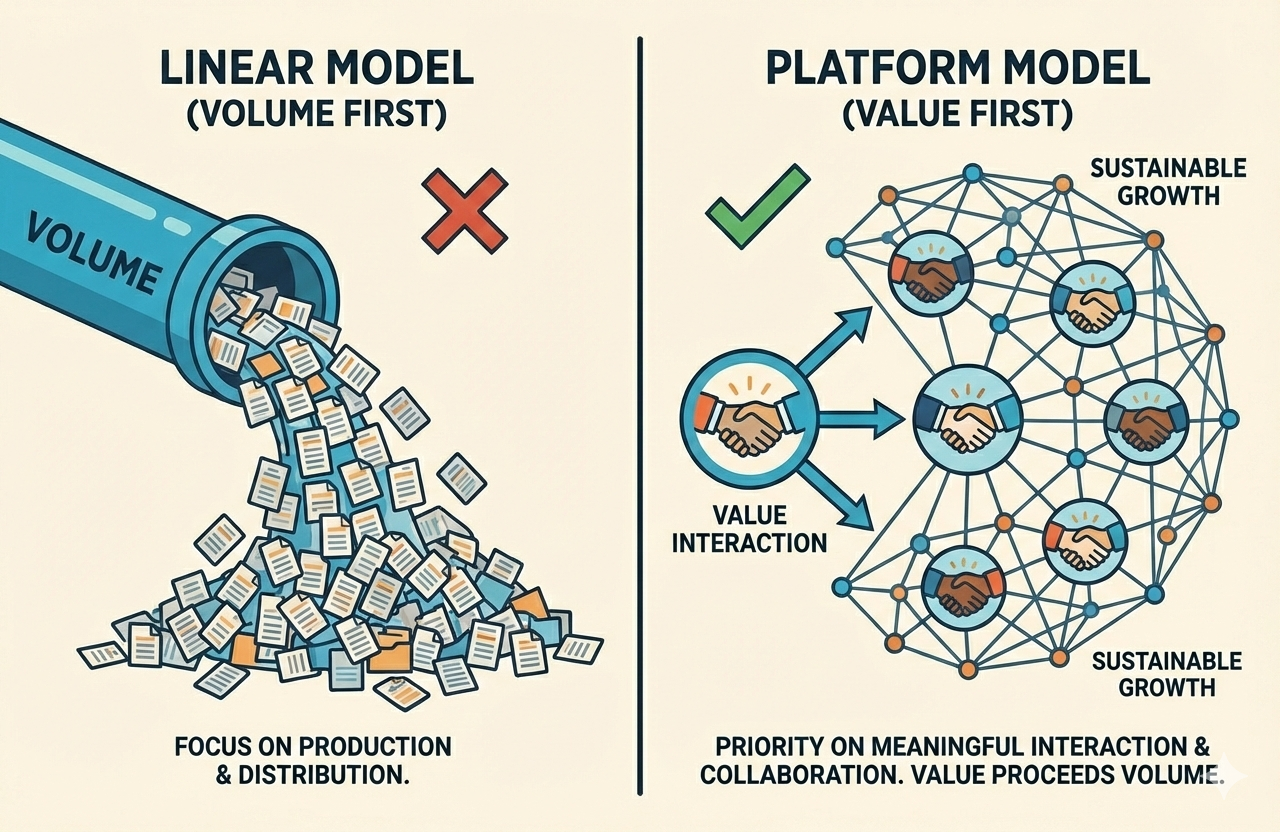

Platforms invert the equation: value before volume

In their seminal HBR article, Van Alstyne, Parker, and Choudary differentiate between linear value chains, which focus on production and distribution, and platform economies, which prioritize interaction.

In a platform model, value is generated through ongoing collaboration, and participants can be both producers and consumers. For financial institutions, this means they can move beyond passive roles to actively share services, utilize external data, gain insight, and engage in value creation within broader ecosystems.

Innovation no longer happens at the edges.

It happens within the network.

The HBR article contends that platforms grow by fostering meaningful interactions rather than simply increasing volume. As valuable exchanges multiply, network effects boost platform utility and attract more users, driving sustainable growth through strong connections rather than sheer numbers.

Value proceeds volume.

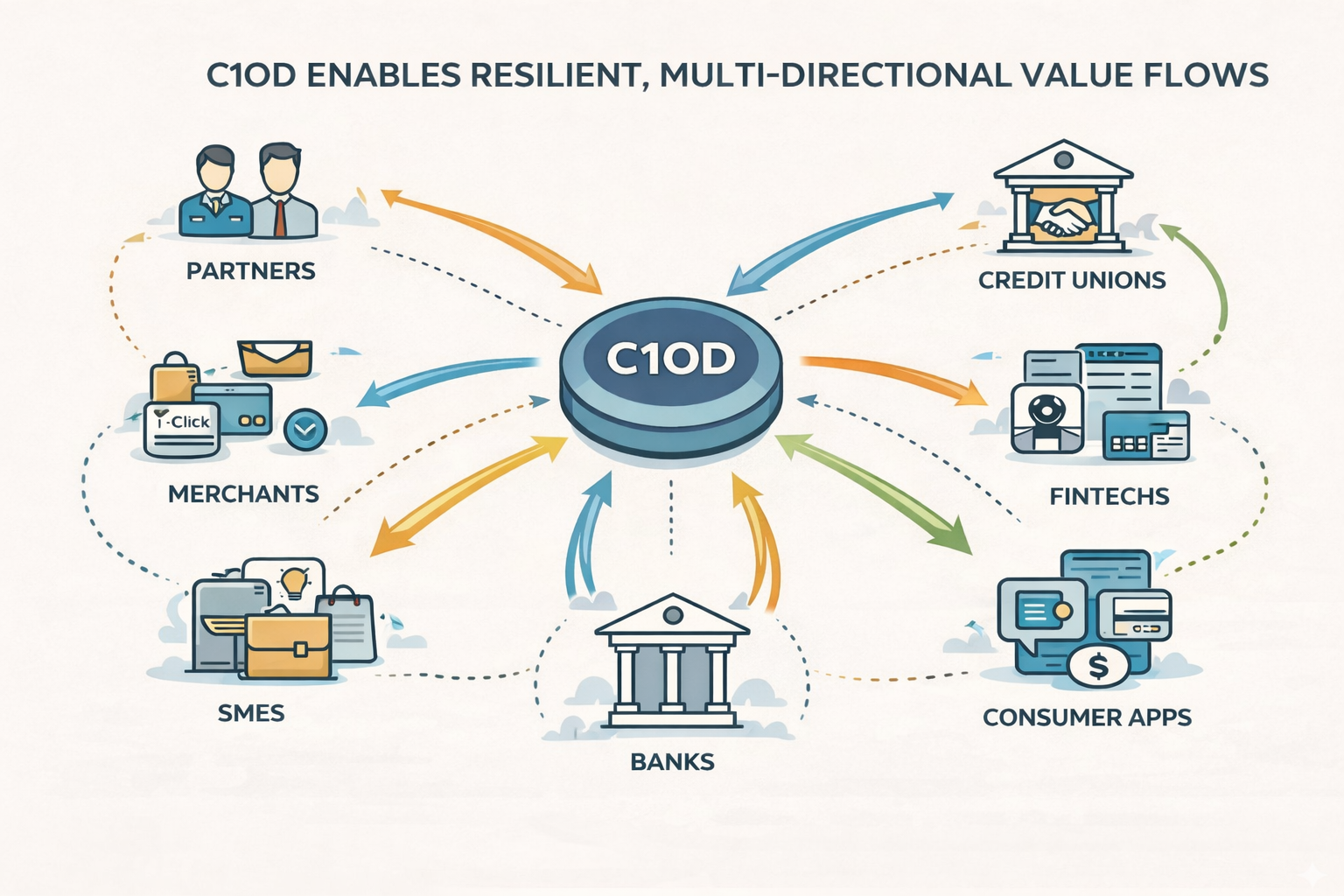

Caspian One Open Data: Powering the Platform Economy

Caspian One Open Data (C1OD) is not an aggregator or marketplace, but a secure, trusted based, platform enabling direct, and commercial connections between financial institutions and third parties. It moves beyond superficial integrations and their extractive models, focusing instead on building trust and real value within a dynamic financial ecosystem.

By supporting flexible, point-to-point multi-directional value flows, C1OD lets banks and credit unions control how value is created and shared. The platform prioritizes meaningful connections over sheer transaction volume, helping institutions adapt, expand their reach, and regain strategic control as finance shifts from linear pipelines to resilient, future-ready platforms.

This evolved operating model enables banks and credit unions to:

Project their financial capabilities seamlessly into external platforms and ecosystems

Incorporate external data directly into their decision-making processes

Engage proactively in value creation, moving beyond the passive role of data providers

Extend trust, identity, and financial services well beyond their proprietary channels

Drive innovation through collaborative networks rather than isolated, peripheral efforts

What’s more, C1OD is building future-ready capabilities for artificial intelligence within this ecosystem; possibilities unlocked only through our trust-based framework. This isn’t just an attractive AI service bolt-on, but a structural foundation that enables secure, optimized operations, leveraging the integrity and reliability of our architecture. By prioritizing a trust-centric approach, we ensure that intelligent automation and data-driven decisioning are seamlessly integrated, empowering financial institutions to confidently innovate and collaborate in ways that were previously unattainable. Additionally, these AI-driven capabilities help streamline operations, reduce manual workloads, and increase efficiency across core processes. This allows organizations to focus resources on higher-value activities, further enhancing their ability to adapt and thrive in a rapidly evolving financial landscape.

As financial services continue to transform, now is the time to define your institution's role in this new era. Let's discuss how you want to operate. Reach out today to start the conversation about building a strategy that positions you for success in the future of finance.