From Data Portability to Platform Advantage: A Response to the Competition Bureau Canada’s Report

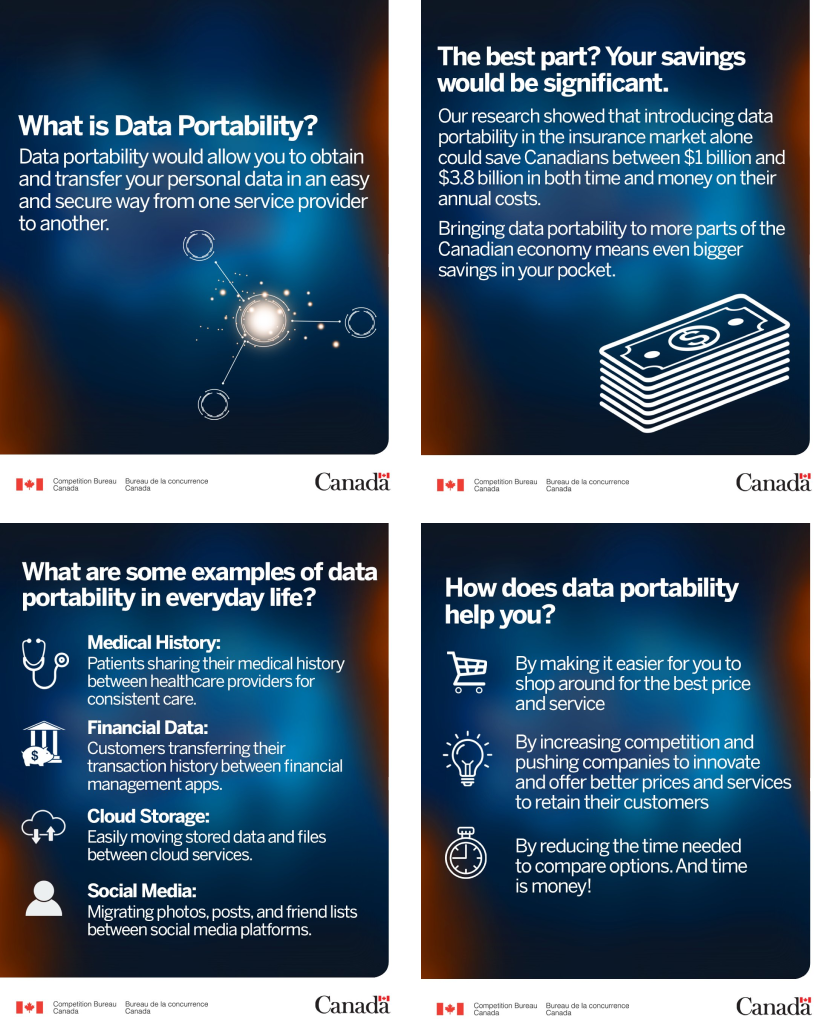

The recent Competition Bureau Canada’s report on data portability is an important step forward. It rightly focuses on consumer benefit, competition, and innovation, estimating that portability could save Canadians billions.

However, at Caspian One Open Data (C1OD) we believe that when data portability is framed chiefly as a tool for consumer switching, as in this report, it naturally signals margin pressure for institutions, making participation more likely to be exclusively driven by mandate than by perceived strategic benefit.

Based on our experience building open data platforms globally and in Canada, we see a far broader opportunity: treating data portability as platform infrastructure that enables institutions, not only across banking, but across financial services and adjacent sectors, to participate in ecosystems, project capabilities beyond owned channels, and create value through collaboration rather than compliance.

When Data Portability Is Reduced to Switching Providers

This tension between consumer benefit and institutional incentive is not new. In the UK, open banking began as a switching remedy and fostering innovation and competition too. For many large institutions, it was treated accordingly: a compliance requirement rather than a strategic opportunity. Engagement was cautious, innovation incremental, and participation largely mandate-driven.

What changed was not the regulation, but how some institutions treated the new infrastructure.

As open banking matured, standardized APIs and interoperable data began to reduce operational friction, improve risk and onboarding, and enable banks to distribute services beyond their own channels. Challenger banks accelerated this shift, forcing incumbents to move into more digital first feature imitation and toward deeper capability-building.

Open banking moved beyond switching. It became platform infrastructure.

That lesson matters now for Canada’s exploration of data portability, particularly as it extends into insurance and adjacent sectors. The country has the advantage of hindsight: the opportunity to move beyond a switching-only narrative and treat portability as a foundation for ecosystem participation, new revenue streams, and diversified market share, especially among digitally native generations.

Where Caspian One Open Data fits

C1OD is built to support this shift in practice, not just in principle. We are not an aggregator, or an intermediary that sits between institutions and siphons value out. We don’t monetize that data access or penalize volume.

Instead, C1OD provides a secure, trust-based open data platform that allows banks, credit unions, and partners to connect directly, share data with consent, and collaborate in ways that create value on both sides.

In Canada, C1OD are already working with forward-thinking credit unions on their voluntary, market-driven basis. These institutions are not participating because they are mandated. They are participating because they see open data as a means to extend their reach, improve efficiency, and participate in markets where collective capability creates stronger outcomes.

This is particularly important for smaller institutions. Acting alone, scale is limited. Acting together, value compounds.

Unlike extractive models that centralize value outside the institution, C1OD is designed to keep value with the ecosystem participants. It supports collaboration, shared capability, and collective progress, while allowing each institution to retain control over its relationships, brand, and strategy.

In this way, open data becomes more than a compliance response. It becomes a practical enabler of digital transformation, ecosystem participation, and sustainable growth for Canada’s credit union system.

Open banking, executed well, became early platform infrastructure.

Beyond Canada, we see this in markets such as Singapore and Hong Kong, where participation in open data has not been driven primarily by mandate. DBS Bank is a standout example. Rather than treating APIs as compliance plumbing, DBS invested early in API-first architecture and opened its capabilities to external developers, fintechs, and non-financial partners.

Through its API platform, DBS embedded payments, lending, identity, and data services directly into third-party journeys: from marketplaces and business tools to lifestyle and commerce platforms. This allowed DBS to distribute its services beyond its own channels, partner across sectors, and participate in ecosystems where customers already were.

The result was not just better digital experiences, but faster innovation, new revenue opportunities, and sustained relevance. DBS’s repeated recognition as one of the world’s leading digital banks reflects this shift: success came not from APIs as pipes, but from APIs as a foundation for ecosystem participation.

The lesson is clear: open banking stopped being just about account data, but rather, an early expression of a shift from pipeline business models to platform economies (see our recent post here to read more on this strategy shift).

But, what’s in it for me?

The Competition Bureau Canada’s report highlights data portability as a powerful tool for improving consumer choice and outcomes. But success requires institutional participation. When portability is seen only as making switching easier, engagement on the industry side will be reluctant. When it is recognized as platform infrastructure, it enables new revenue opportunities, operational efficiencies, and ecosystem collaboration that can strengthen, not erode, institutional economics.

Data portability doesn’t just help consumers leave, it empowers institutions to engage in new ways.

Take home buying. For consumers, it is one big life event. For the industry, it is still delivered as a fragmented chain of products, providers, and processes.

In a platform-based model:

Data moves to support the entire journey.

Identity and income are verified once.

Mortgage decisions and home insurance are embedded together.

Compliance processes are reused.

Services activate seamlessly.

Friction is removed not by speeding up individual steps, but by eliminating duplication altogether.

The same applies to smaller, everyday moments: protecting a new purchase, updating cover after a change in circumstances, supporting a move, a renovation, a growing business. These moments are rarely about switching providers.

This is the difference between portability-as-exit and portability-as-participation.

Defining the future, not reacting to it

We are already seeing this report move beyond industry circles and into the public domain (images above from the Bureau’s social media platforms). Through consumer awareness campaigns, data portability is being positioned not just as a policy discussion, but as a right consumers should expect.

Data portability is coming, whether through regulation or market pressure. The Competition Bureau Canada’s report makes that direction clear.

The question now is not whether data will move, but how institutions choose to engage with the infrastructure that enables it.

Those who treat data portability purely as a defensive obligation will comply. Those who recognize it as platform infrastructure will shape what comes next.

The real opportunity is not just to make it easier for customers to leave, but to create ecosystems worth staying in.

If you’d like to explore how platform-based open data can unlock that future, we welcome the conversation.