Emma's Seamless Freshman Start: The Zero-Friction Acquisition Strategy That Secured a Lifetime Customer.

You’ll remember Jayne, our embedded finance florist from the Valentine’s Story. Long before the flowers, invoices, and the shop, was a freshman with a suitcase, stepping into adulthood for the first time. What Jayne wanted more than anything wasn’t freedom in the poetic sense, just her own accommodation, her own bank accounts, and her life switching on, financially and personally in one go.

Instead of a smooth start, she just walked into noise. The usual first-week scene, long corridors of freshmen stalls, all major banks lined up, branded lanyards, freebies, flyers promising “the best student deal” on a bank account, first credit card and even small loans. Every provider fighting for attention because this moment mattered. A lifetime customer starts here. To a bank, it’s acquisition, to a student, like Jayne, it was overwhelm. She just wanted to walk the simplest path to the quickest account onboarding. That first week wasn’t freedom, it was figuring things out. It wasn’t just stressful, it was slow and painful, filled with friction. Appointments, manual identity checks, stretched the account opening from days into weeks.

Now it’s Emma’s turn, Jayne’s younger sister, stepping onto her campus 15 years after her sister. Not much has changed really. The stalls, the banks, the lanyards, the banners the freebies, still there. But Emma, just walks past, coffee in hand, unbothered and unburdened. Because everything those stalls have, she already has. Completed weeks earlier inside one onboarding experience, not by accident but because Emma’s university is part of an open data ecosystem where financial services are woven directly into the student experience.

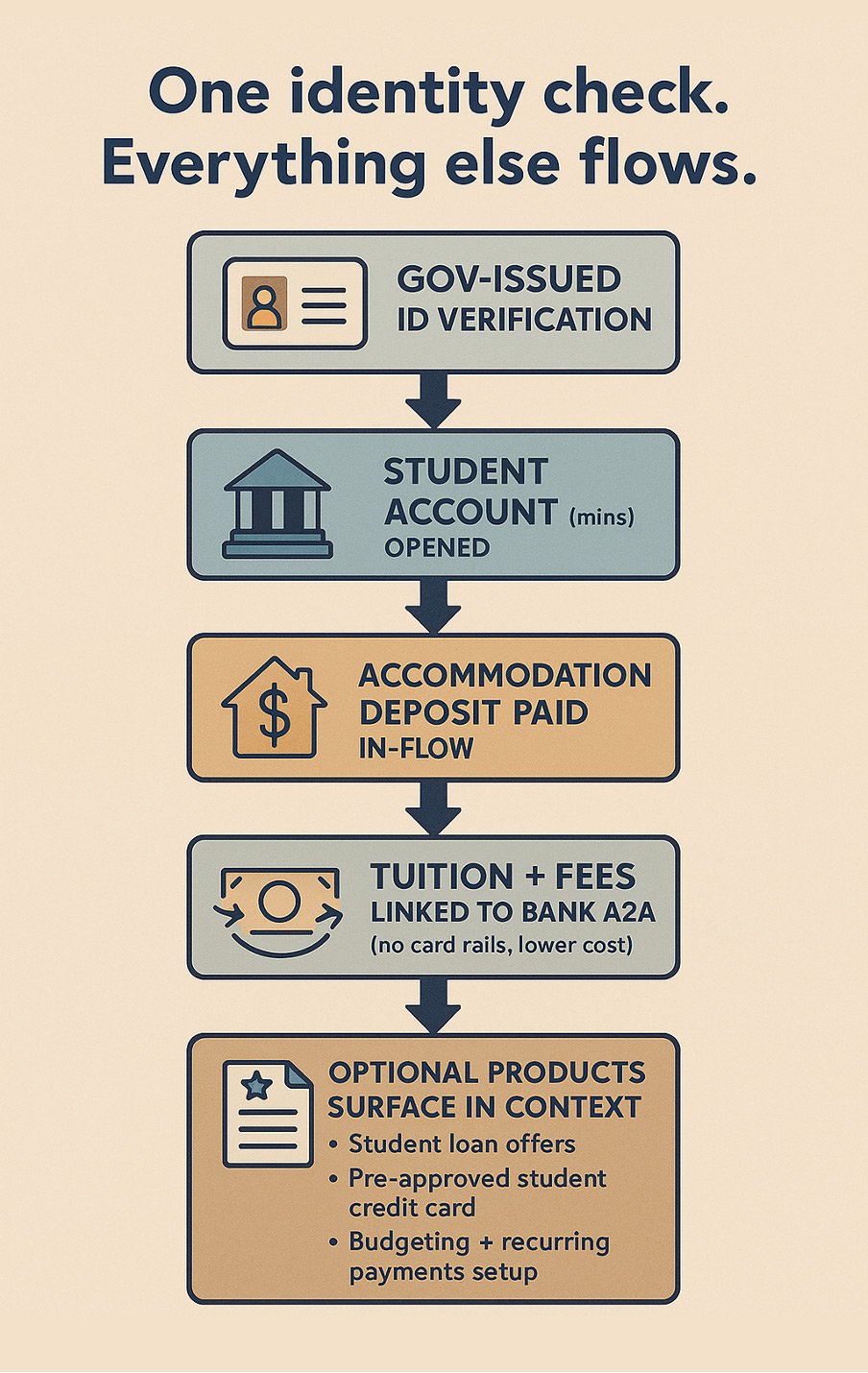

This enabled a simple idea. Emma only verified her identity once. The government issued ID needed after her offer acceptance wasn’t filed away or wasted, it was trusted within the ecosystem, passported forward, and reused automatically when needed; to open her student account. No repeated upload, no “please bring your documents in”, just one identity check that powered every step that followed.

From there, everything unlocks:

One trusted identity

Student account opening took minutes, not weeks

Accommodation deposit secured

Account to account payments

"pre-approved credit card” and “loan offers” inside the school student account

Emma didn’t have to seek out financial services and she didn’t have to be sold to either. No booths calling her over, no branded stress-balls in exchange for signatures, no pressure to pick a bank on the spot. In an open data ecosystem, banks and credit unions don’t win by shouting the loudest. They don’t need flyers, booths, or marketing theatrics to compete. They win by showing up at the exact moment of relevance, quietly, seamlessly, already woven into her onboarding journey.

When the university embeds account opening, payments and financial products directly into student onboarding, FIs gain something they’ve historically struggled to capture:

Early access to lifelong customers

Lower acquisition costs and higher conversion

Secure identity already verified

Verification costs reduced

Direct payment rails, fewer card costs

Loan distribution becomes contextual

Financial needs are everywhere people are, not just in branch, not just at checkout, but in the real flows of life. Where decisions happen, where milestones begin, where identity, access and payments converge. The future isn’t separate portals and parallel processes. It is financial services showing up in context: naturally, invisibly, at the point of need.

This university example is only one expression of that shift. The same pattern applies to payroll, business tools, dealerships, ecommerce, healthcare, automotive, government and beyond. Wherever financial intent occurs, embedded finance has a place.

Caspian One Open Data provides the infrastructure that makes this scalable, connecting institutions to the moments that matter, not through channels, but through participation. One connection, with many scenarios and this is where the future moves next.

Emma feels that future even if she can’t name what it is. As she steps into her new room, bag still on shoulder, sets her coffee on the empty desk, and notices the only thing breaking the empty space – a vase of flowers Jayne sent before she left. A note wishing her luck on her exciting start.

Same milestone. A world apart in experience, and open data just removed the friction around it.

Two generations crossed the same threshold; one carried paperwork and appointments, the other just her coffee.